Introduction

Tax Deducted at Source (TDS) is a critical compliance requirement for companies operating in India.

Oracle Fusion offers a robust framework to automate TDS calculations, streamline supplier payments,

and ensure accurate tax reporting. In this blog, we’ll walk through the complete setup and configuration

of Withholding Tax (TDS) in Oracle Fusion Applications.

Why TDS Configuration Matters

TDS is deducted when making payments to vendors like contractors, professionals, and rent services

providers, etc. Accurate configuration ensures:

- Automatic tax deduction at the correct rates

- Proper accounting treatment

- Timely remittance to tax authorities

- Reduced manual effort and errors

Set Up and Configuration of Withholding Tax

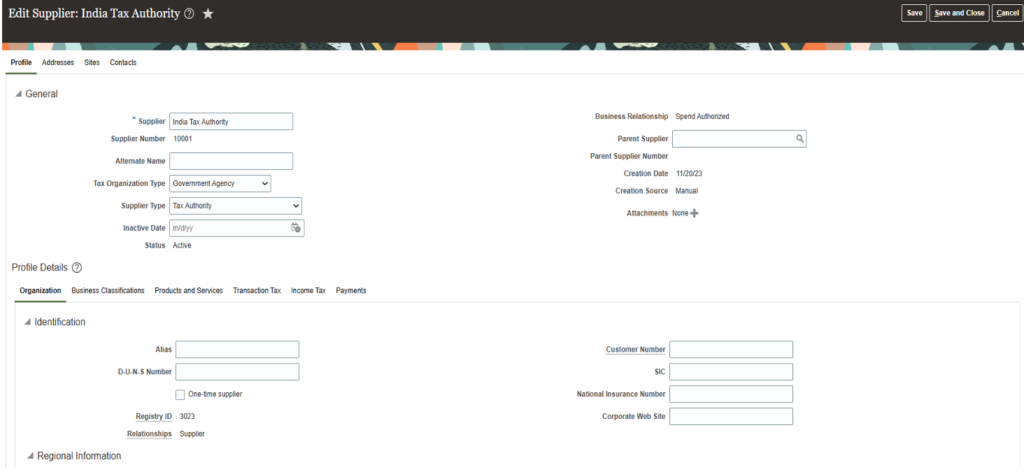

1. Define the Tax Authority

- In Oracle Fusion, a Tax Authority can be created as a supplier (e.g., Income Tax Department).

- This setup enables tracking and payment of TDS like a regular supplier.

- Used for remitting deducted TDS from vendors to the government.

Navigation: Procurement > Supplier > Task >Create Supplier Just enter basic information like name,

country, and a registered address to identify the authority in the system will be enough

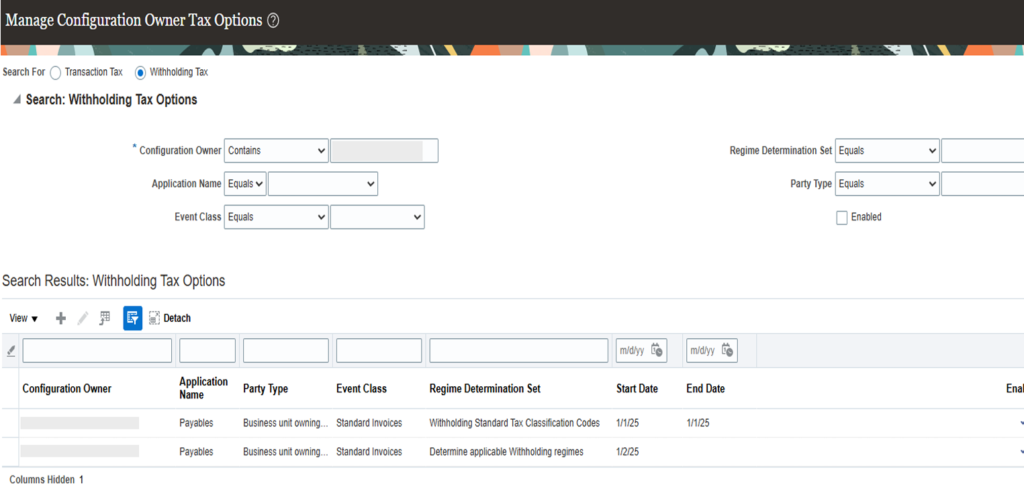

2. Manage Configuration Owner

- Before defining taxes in Oracle Fusion, it’s important to assign a Configuration Owner.

- This tells the system who owns and controls the tax setup—either a specific Legal Entity or a

Business Unit. - The configuration owner ensures that the defined TDS taxes, regimes, and rules are correctly applied

applied to transactions related to that entity. - It acts as a foundation linking your tax setup to your business operations.

- Navigation: Setup and Maintenance> Manage configuration owner tax option

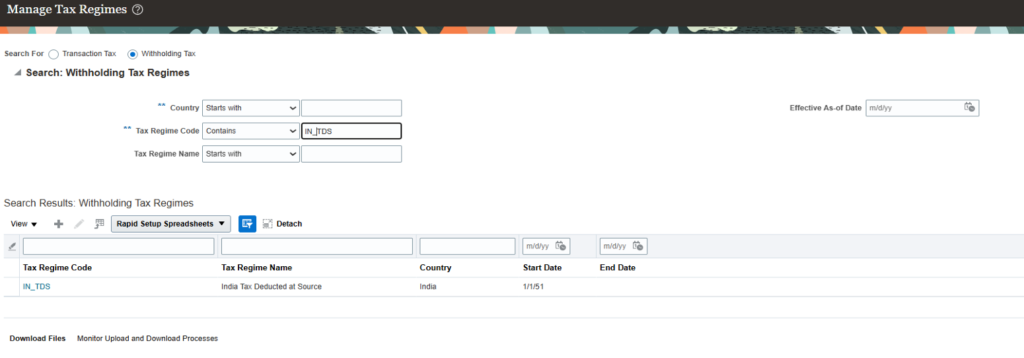

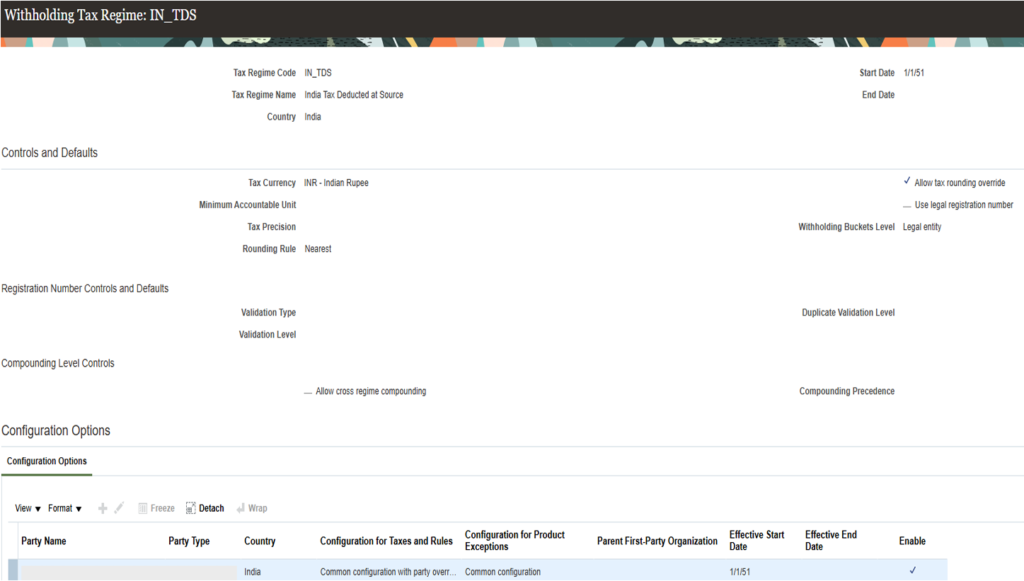

3. Create the TDS Tax Regime

- TDS Tax Regime acts as the foundation for configuring all TDS-related taxes.

- It defines the jurisdiction and structure under which your withholding taxes will operate. For

India, you typically create a regime named like “TDS IN” and link it to the country , your legal

entity, Enable the Withholding Tax Regime , and add your LE under configuration option - Navigation: Setup and Maintenance> Manage Tax Regimes

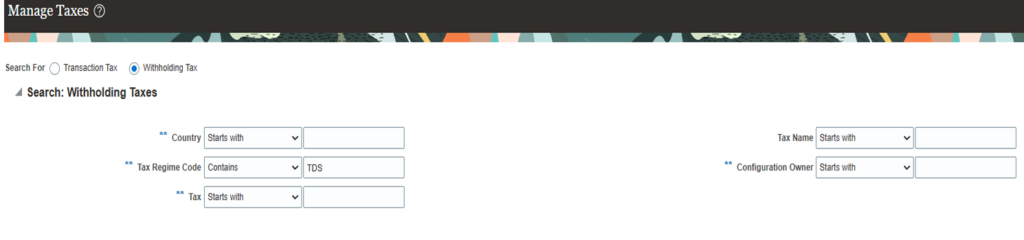

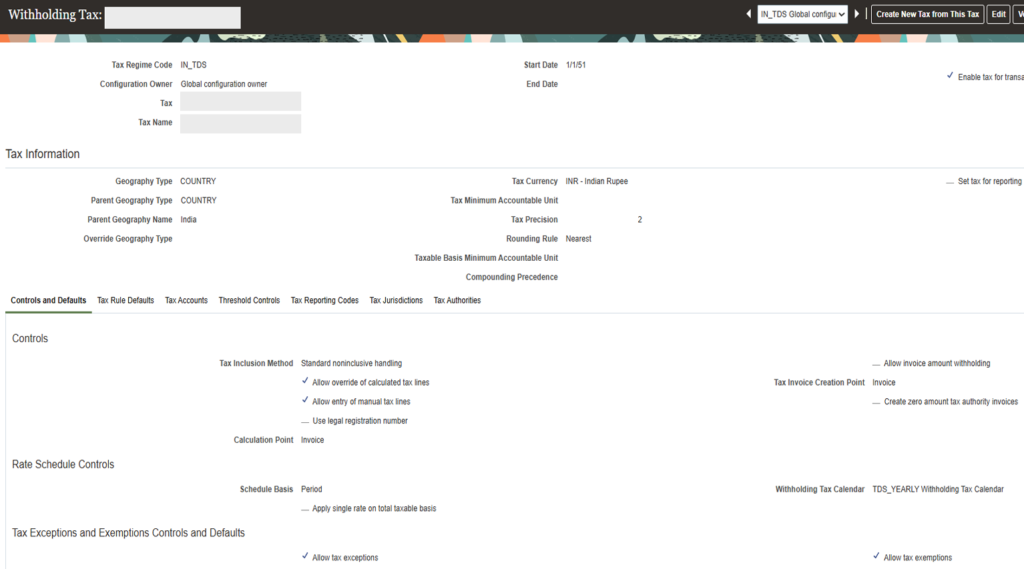

4. Set Up Withholding Tax

- Once the tax regime is created, you can define specific TDS taxes under it—for example, TDS

under section 194C for contractor payments. - This includes assigning a tax name, regime code, Tax rate, Jurisdiction , status and linking it to

the earlier defined tax authority and BU - These withholding tax definitions control how the system calculates TDS on supplier invoices

based on applicable rates - Navigation: Setup and Maintenance> Manage Tax

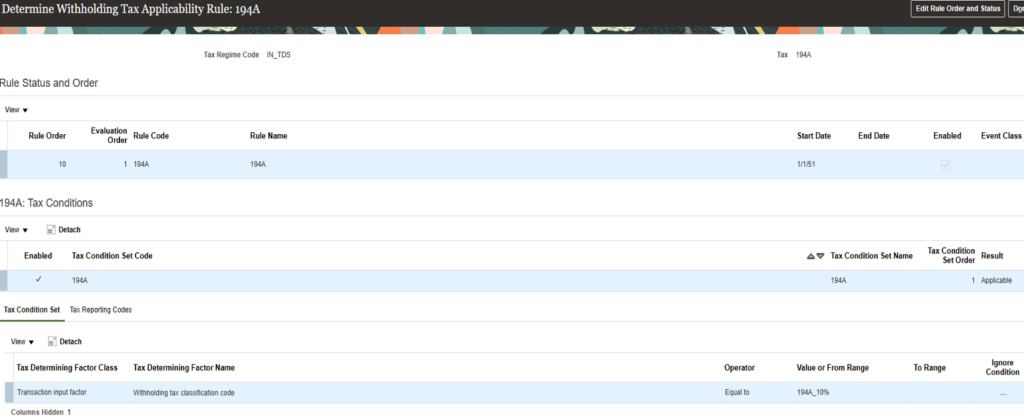

5. Create Tax Rules (Optional but Recommended)

- Tax rules in Oracle Fusion help control when and how TDS should be applied based on

specific conditions. - For example, you can configure rules to deduct TDS only when the invoice amount exceeds a

threshold, or when the supplier falls under a particular category like contractors or professionals. - Fill in Configuration Owner, Rule Code, Rule Name, Tax Regime Code (e.g., IN_TDS), Start

Date, Tax, and Code under Tax Determining Factor Set (e.g., SUPPLIER or INVOICE

AMOUNT). - Navigation: Setup and Maintenance> Manage Tax rules

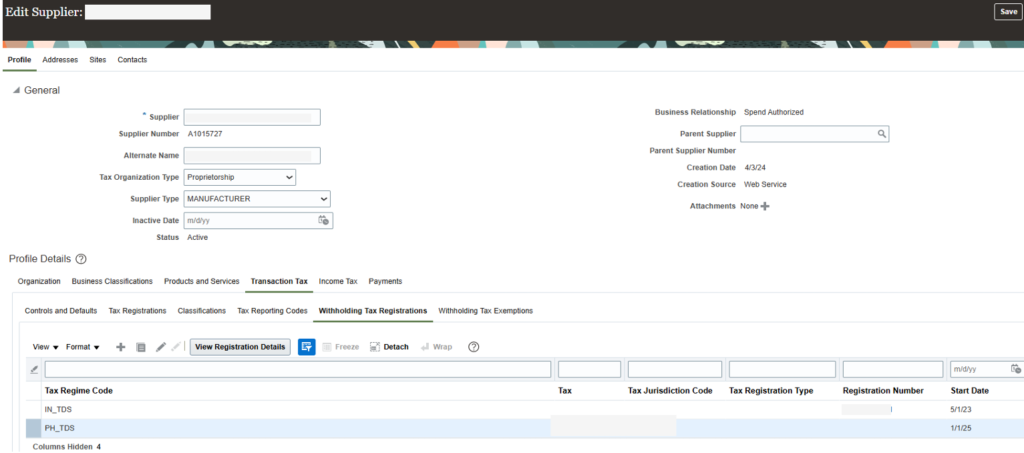

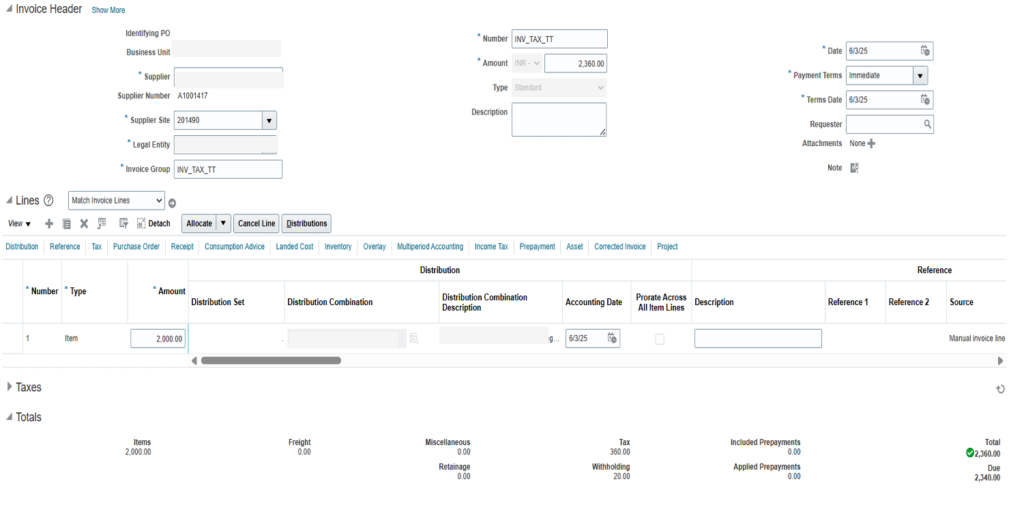

6. Assign Tax code to Suppliers and create invoice with TDS auto Calculation

- Before creating invoice, assign the supplier with WTH tax regime code, tax, jurisdiction code

under withholding tax registration - Create invoice for assigned supplier, BU and at line level under withholding tax enter tax code

for auto tax calculation - Navigation: Procurement > Supplier > Task > manage Supplier

- Navigation: Payables> Invoice > Task >Create invoice

Conclusion

Configuring TDS in Oracle Fusion streamlines tax compliance by automating deduction, calculation,

and reporting. With proper setup of tax regimes, rules, and supplier assignments, businesses can ensure

accurate and consistent TDS handling. This reduces manual effort, ensures timely remittance, and keeps

your operations audit-ready and compliant with Indian tax laws

Leave a Reply

You must be logged in to post a comment.