GST compliance requires accurate storage of the supplier GSTIN in Oracle Fusion. Fusion offers two levels for storing vendor GST:

1.Party Tax Profile Level

2.Party Address Level

Knowing where to store and when ensures:

Correct GST determination

Accurate tax calculation during AP invoice validation

Seamless statutory reporting and compliance.

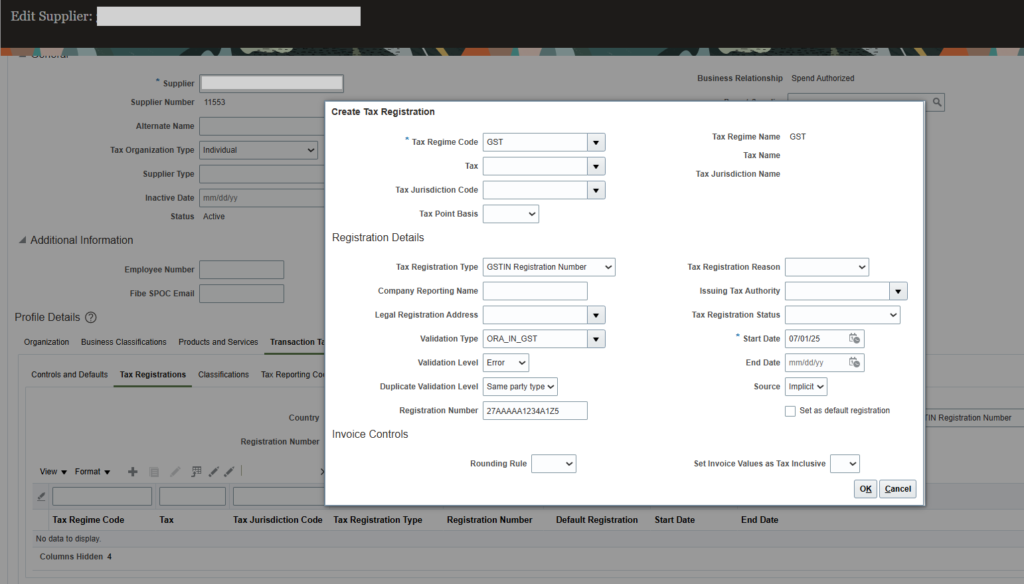

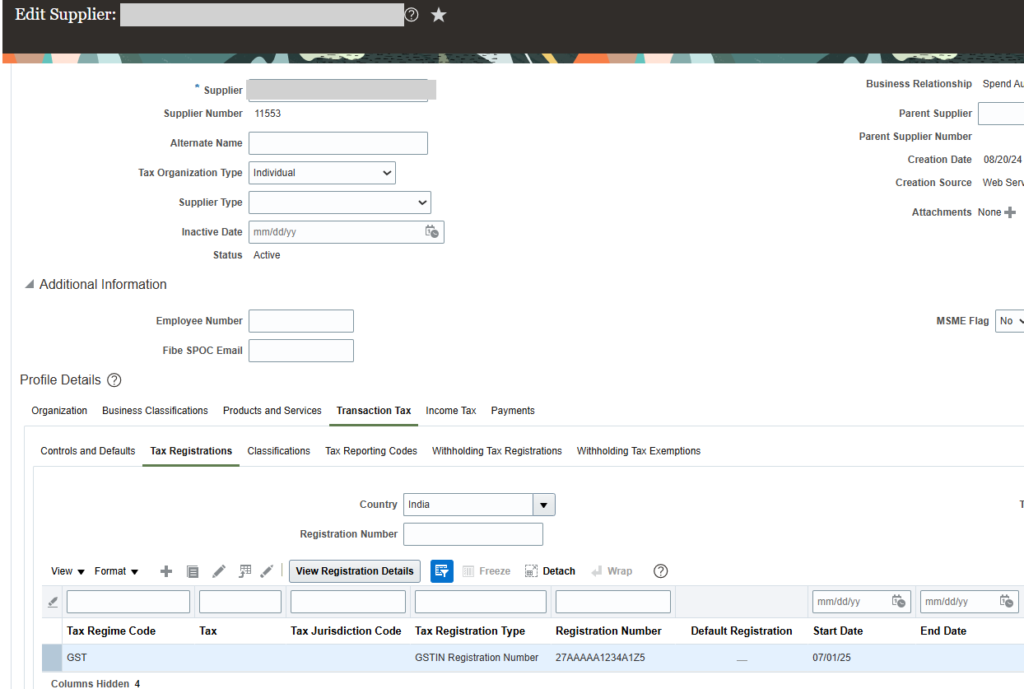

1️. Storing vendor GST at party tax profile level

What it is:

- Linked to the Supplier Party (Supplier Header) in Oracle Fusion.

- Represents GST registration applicable across all supplier sites under the same supplier.

Navigation: Procurement > Suppliers > Manage Suppliers

- At the Profile level, go to GST Registration under Tax Registrations, click on add (+), and enter:

- Registration Number

- Registration Type

- Effective Dates

- Tax Regime Code

This profile is mandatory for tax determination and correct place-of-supply processing.

When to use:

- When the supplier has only one GSTIN for all transactions across India.

- When your organization uses a simplified GST management approach without a state-wise breakup.

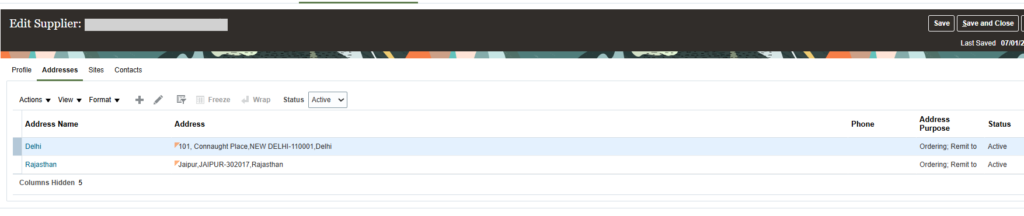

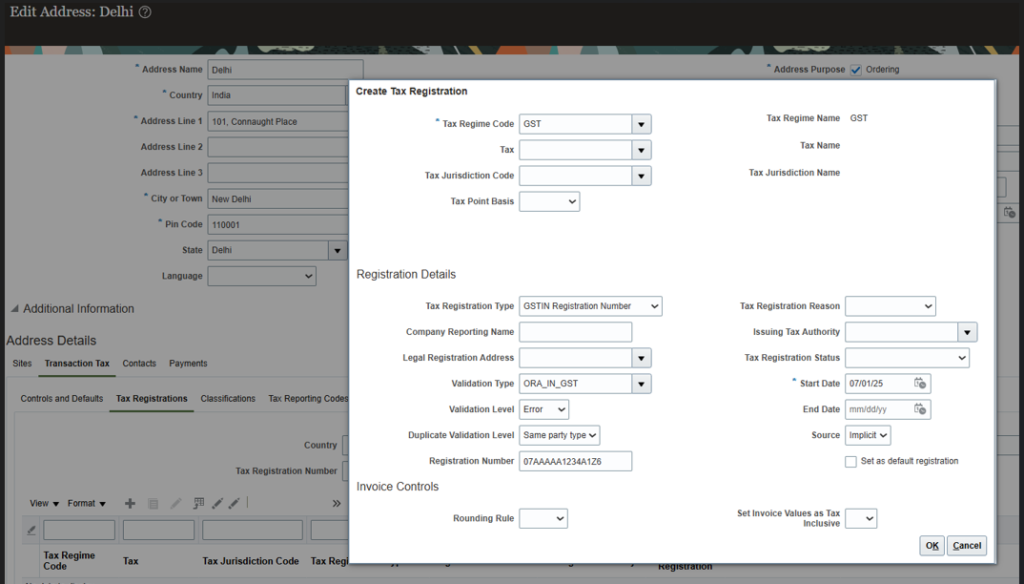

2️. Storing vendor GST at the address level

What it is:

- Linked to the Supplier Site (Supplier Address Level).

- Allows maintaining state-wise GST registrations for the same supplier.

Navigation: Procurement > Suppliers > Manage Suppliers > Supplier Address

For Example:- The Company operates in Delhi with a GSTIN for Delhi and Rajasthan with a GSTIN for Rajasthan. Select any address and edit, at the address detail click on tax registration under transaction tax, and click on the add button

When to use:

- When the supplier has multiple GSTINs in different states.

- If transactions need a site-specific GSTIN application for correct place-of-supply handling.

- Useful for large vendors with operations in multiple states and state-wise billing.

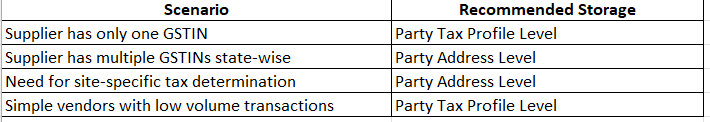

Which one to choose and when?

Conclusion

Storing vendor GST correctly in Oracle Fusion:

- Reduces manual corrections in AP processing.

- Ensures accurate GST calculation and compliance.

- Supports audit readiness and reporting.

Leave a Reply

You must be logged in to post a comment.